The Indian banking system is recognized as being robust and well regulated. Since nationalization, the Indian banking system has undergone dramatic changes. For example, recently India became one of the few countries to begin implementing Basel III norms. On the other hand, banking system is yet to penetrate into the hinterlands. Around 41% of the Indian population is still unbanked, of which, 40% belong to urban regions, while 60% belong to rural areas. Only 14% of the adult population has access to credit accounts with formal financial institutions.

What is financial inclusion and why is it so important?

According to the Planning Commission (2009), financial inclusion refers to universal access to a wide range of financial services at a reasonable cost. These include not only banking products but also other financial services such as insurance and equity products. The household access to financial services includes access to contingency planning, credit and wealth creation. Access to contingency planning would help for future savings such as retirement savings, buffer savings and insurable contingencies and access to credit includes emergency loans, housing loans and consumption loans. On the other hand, access to wealth creation includes savings and investment based on household’s level of financial literacy and risk perception.

The Reserve Bank of India (RBI) continues efforts to ensure extension of banking facilities to all unbanked villages. As a result, around 490,000 unbanked villages with population less than 2000 were identified. Banks are required to extend coverage under the on-going Phase II of the financial inclusion roadmap. As reported by the State Level Bankers Committees (SLBCs), around 390,387 villages were covered by 14,207 branches, 357,856 Business Correspondents (BCs) and 18,324 other modes, such as automated teller machines (ATMs) and mobile vans were setup as of March 2015.

Pradhan Mantri Jan Dhan Yojana (PMJDY)

The Pradhan Mantri Jan Dhan Yojana (PMJDY) is perhaps the most significant initiative towards financial inclusion in India till date. PMJDY is on its way to achieving its goal and has been instrumental in bringing almost all families of the country into the formal financial system. It has enabled citizen at grassroots level to perform financial transaction and keep their hard earned money safe. The scheme was started with the objective to provide universal access to banking facilities’ through:

(a) “Basic Saving Bank Account” with an overdraft up-to Rs.5,000 subject to satisfactory operation in the account for six months

(b) RuPay Debit card with inbuilt accident insurance cover of Rs. 1 lakh and

(c) Provision of social security schemes, i.e. Pradhan Mantri Suraksha Bima Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana and Atal Pension Yojana.

As of August 2015, around 180 million bank accounts have been opened covering nearly all households and the expectation is that eventually wage payments and subsidies will be directly routed to the bank accounts of beneficiaries.

Financial Inclusion Plan (FIP)

Under the Financial Inclusion Plan (FIP), the Reserve Bank of India (RBI) has been encouraging banks to adopt a structured and planned approach towards financial inclusion.

Out of 3,445 rural bank branches opened during 2014-15, 2,230 branches were opened in unbanked rural centres. Around 155 million basic savings bank deposit accounts (BSBDAs) were added taking the total BSBDAs to 398 million. This includes 147 million accounts opened under PMJDY. With the addition of 2.6 million small farm sector credit accounts (Kisan Credit Cards-KCCs) and 1.8 million small, non-farm sector credit accounts (General Credit Cards - GCCs), the total number of such accounts went up to nearly 42.5 million and 9.2 million respectively.

Much has been done to increase the outreach of the financial system and tap into the unbanked population of the country. While the ongoing efforts of the government and the RBI are showing signs of success, it is however too early to declare victory. There is still a long way to go as financial inclusion has helped in opening basic bank accounts for the excluded but ensuring it remains operational requires sustained efforts. This will be possible only if all government subsidies and payments are routed through the banking channel. Besides, improved infrastructure facilities and a technology based BC model with proper network connectivity is key to the long term success of the programme.

Some earlier studies have shown that there are still many untouched pockets in the country that remain isolated from formal financial services. As per the available information compiled by NSSO (2012), there are about 203 million households in India. Around 89.3 million households are farmers, of which 51.4 percent (i.e. 45.9 million out of 89.3 million) are financially excluded from both formal and informal financial sources. In addition, 256 districts out of 640 districts in India (representing 40 percent of total districts), have critical credit exclusion thresholds in respect of access to formal credit.

Northeast, Eastern and Central India account for 64 percent of all financially excluded farmer households in India. Overall indebtedness to formal finance sources is low at 19.66

percent in these three regions.

Scope for gold loans in Northeast

The Gold Loan business can be a boon to the regional economy by making small ticket loans easily available to the financially excluded. Our preliminary studies indicate good potential for gold loans in the isolated north east region (NER) of India. If we can expand our branch network to this region manned by trained staff with local knowledge, it would service the financial need of the region and deepen the financial inclusion process.

Some basic fact about the NER of India (which consists of eight states, namely Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Tripura and Sikkim) are as follows:

• The region covers an area of around 2.62 lakhs Sq. Km. constituting 7.9 percent of the country’s total geographical area. According to the 2011 census, total population of NER is around 45 million (about 3.8 percent ) of the country’s population.

• More than 80 percent of the population resides in rural areas.

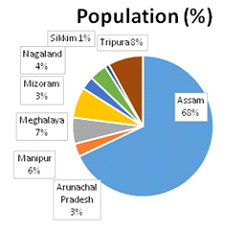

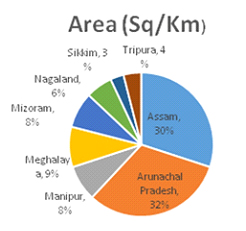

• State-wise distribution of population and area in the NER is shown below:

Data above indicates that 68 percent of total NE population lives in the state of Assam and the same accounts for 30 percent of total area. Consequently, the population density varies greatly from 17 per sq.km in Arunachal Pradesh to 397 per sq.km in Assam.

Some progress has been made in the planning and developmental agenda of the Central and the respective state governments. The government has declared Northeast India as Special Category Region. In addition, the Government of India and the Reserve Bank have initiated various measures for spread of banking and promotion of financial inclusion. Nevertheless, the pace of growth in financial inclusion in NER is still slow. Only one applicant from the entire NER and Eastern India—RGVN Microfinance of Assam—was granted a small finance bank license by the RBI. The region needs more and we should expect more action from both the government and RBI in the near future.

The Northeast region has good potential to grow at a rapid pace. Recent data published by CSO (Oct 2014) on State Gross Domestic Product (SGDP) growth rate at constant 2004-05 prices shows that the NER reported strong growth rate. Highest growth was recorded by Meghalaya at 12.41 percent and lowest by Assam (5.87 percent). The five year average SGDP growth rate for most of the NER is around 6 percent, indicating a high growth region.

Conclusion

Financial inclusion can play a vital role in the development of the isolated unbanked areas of the country. To strengthen and deepen the financial system, both RBI and the government need to increase financial awareness and invest in basic infrastructure facilities. The government should also consider encouraging NBFCs to expand their operations in this region because they possess the experience and expertise to operate in tougher environments. Manappuram Finance can contribute to the economy of the region to mutual benefit by increasing its exposure in these isolated unbanked areas. Its expert and trained staff can cater to the basic short term financing needs of the local population through Gold Loans.

Sujit S Kawoor

(DGM and Sr. Economist)