Why go for Personal or Business loans when you have the power of gold with you! Get a loan against your gold, in minutes!

Instant Gold Loan

- Draw instant Cash by pledging your Gold Ornaments and Jewellery.

- Higher loan amounts, depending on purity, net weight of the gold.

- Choose from a range of schemes; there’s one just right for your needs.

FAQ

What is a gold loan?

Gold loans are secured loans where the customer pledges the gold ornaments they hold as a collateral deposit against the money they are going to receive. Gold loans are usually taken for short term financial obligations.

Why Gold loans are preferred over personal loans?

Gold loans are secured loans whereas personal loans are unsecured. The gold loan requires a collateral deposit, where the gold itself is pledged against the money the customer receives, while in personal loans collateral deposits are not required. Gold loans allow greater disbursal amount; through the gold loan, you can draw up to 5 crores while personal loan allows disbursal up to just 40 lakhs. The lower interest rate of the gold loan is another feature that has convinced people to avail gold loan facilities widely for their financial requirements.

How to apply for a gold loan?

Procedures included in the application for a gold loan are very simple. You have to first approach a lender, the lender will value your gold and calculate the maximum amount you can borrow. You will be required to fill a loan application for this and submit necessary documents such as copies of ID proofs and valid address proof. Once the value is calculated the money is instantly disbursed and you can use it for your intended purpose immediately.

Who can apply for a gold loan?

Anybody over the age of 18 can apply for a gold loan provided he or she is the actual owner of the ornaments they present. The banks are not required to consider factors such as income, age, credit score, banking history, etc.

Highlights of Gold Loan

Highlights of Gold Loan

- Minimum Requirements: A certified copy of Passport, Driving License, Aadhaar number, Voters ID, Job card issued by NREGA duly signed by an Officer of the state government and letter issued by the NPR containing details of name and address,One recent photograph,The Permanent Account Number or Form No. 60 as defined in Income-tax Rules,1962.

- Different schemes for different needs, to suit all income groups.

Gold Loan - Extended Services

Visit your nearest Manappuram Finance Limited branch today; there’s a Gold Loan just right for your needs.

Find your Nearest Branch.

Visit your nearest branch today

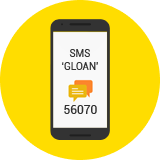

Gold Loan SMS

SMS 'GLOAN' to 56070.