Earning customer trust through technology and innovation

At Manappuram Finance , we understood the importance of innovation and the power of the digital from the time we began our operations. And at a time when there were no readymade software solutions for gold loans, we were one of the earliest to adopt the ‘core banking’ platform to link all our branches real time.

Right from streamlining procedures and reducing the turnaround time in gold loan disbursal to implementing advanced risk management practices, we use technology across our business operations. Through the use of bots, we have managed to increase the precision of our operations and reduce costs.

To continue becoming smarter, efficient and more technology savvy, we have charted a digital strategy that is based on the three pillars of ‘Innovate’, ‘Differentiate’ and ‘Execute’.

| Pillars | Offerings |

|---|---|

| Innovate (strategic) Innovative projects to penetrate more markets, gain more customers and stay ahead of competition |

|

| Differentiate (tactical) Establishment of business differentiators to ensure brand recall and have our own unique selling points |

|

| Execute (operate) Consolidation of Group IT infrastructure by moving to private cloud to serve customers better |

|

Digital transformation journey

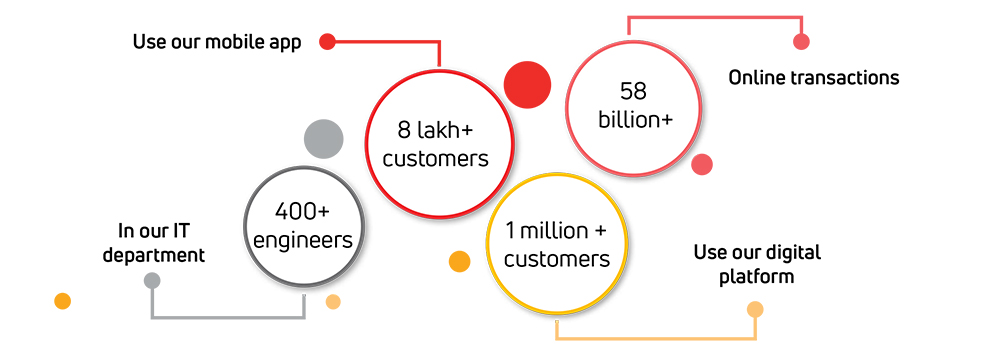

In our journey of digital transformation, we are focusing primarily on four key areas - digitizing operations for scale, mobile interfaces for servicing customers, unified data architecture and analytics for single customer view, and leveraging new technologies for new businesses. We have custom developed an information technology platform in-house that allows us to record relevant customer details, approve them and disburse the loan; and handle internal audit, risk monitoring and management of suitable credit and pledged gold related information.

Advantages of our digital capability

![]()

The share of digital collections in gold loans has increased steadily over time, standing at 54% in FY 2021, compared to 35% in FY 2020

![]()

The Business Continuity Plans (BCP) initiated much before the nationwide lockdown enabled us to roll out new projects and ensure efficient operational methods

![]()

Our digital capability allows us to amplify revenue across business verticals

![]()

We are working towards establishing an automated solution to verifying the purity of the gold assets

![]()

We went largely paperless, with all our information being moved online

Our technology platforms – A boon during the lockdown

We have set in motion transformative change with the virtualisation of the office environment. We started our green office project by implementing a paperless system of moving files. The focus was on making systems and procedures paperless, and tech initiatives were launched to make the operations at Head office completely paperless. Today, everything is digital, saving hours of manual file movements.

We were the first in the country to introduce digital gold loan, our Online Gold Loan (OGL) product. which is today the most successful application of its kind in the industry. Launched five years ago, adoption was relatively slow but after the pandemic struck, there was a marked pick-up. In OGL, the customer can park his gold in our branches and get a drawing power which can be used as an overdraft limit which may be operated from anywhere using a mobile phone. Recently, for the benefit of those customers who face difficulties in reaching our branches, we have introduced a doorstep gold loan service. Our executives call on the customer at his doorstep and the customer gets the gold loan disbursed to him from within the comfort of his home.

As a leader in the NBFC space, Manappuram Finance believes strongly in providing adequate training and learning opportunities to our employees. We made the transition from classroom trainings to virtual classes and eLearning courses, thereby saving time and money. We prepared over 400 e-learning courses of over 220 hours duration and now our Learning Management System is the main platform for learning and development at our Company. We are implementing augmented reality (AR) framework in our training programs to create near real, yet fully virtual classroom environment. AR infused training programmes will impart role critical training and get employees ready for future challenges. AR has the potential to revolutionise the learning industry completely. Technological transformation in the learning space is still in infancy and we are clear that Manappuram will lead from the front.